What is a Hammer Candlestick Pattern?

A hammer is a candlestick pattern that occurs when an asset trades significantly lower than its opening, but rallies within the period to close near its opening price. This pattern forms a hammer-shaped candlestick, what we call a hammer, in which the lower wick is at least twice the size of the body. The body of the candlestick represents the difference between the open and closing prices, while the wick shows the high and low trading prices of the session.

The real body of the hammer can be green or red. This is because even if the real body of the hammer is red, it still closes near its open forming a hammer candlestick. We can say it is slightly more bullish if the real body of the hammer is green. The Japanese nickname for a green hammer candle is a “power line”. The success of the hammer is not dependent on the color of its body, it can be either red or green. The hammer’s long lower wick and close at, or near, the high of the session graphically relays that the market sold off aggressively during the session and then bounced back to close at, or near the session’s high. This could have bullish ramifications. This aspect of closing at or near the highs is why the hammer should have no, or a minuscule, upper wick. If there was a long upper wick, this would mean the market closed well off its highs, which is an important criterion for the hammer.

What does the Hammer Candlestick Pattern Signal?

The hammer is an extremely helpful candlestick pattern to help traders visually see where support is located. After a downtrend, the hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered.

- They can act as leading indicators to identify shifts in bullish or bearish momentum

- Hammers tend to be highly effective when three or more declining candles precede them. When the completed patterns emerge, they can confirm or negate that a potential significant high or low has been reached, helping traders enter and exit positions accordingly.

- The larger the bottom wick length, the greater is the strength of the pattern. This has to continue within an acceptable time frame.

A hammer pattern appears after an asset has been declining in price, which suggests the market is aiming to form a bottom.

Hammer candlesticks signal capitulation by sellers to form a bottom, followed by an immediate price rise to indicate a reversal in the market. This happens all during the one time frame, where the value of the asset falls after the open but then pulls itself together to close near the open.

A hammer should emulate the letter “T” in the candlestick pattern and appears on all time frames, including everything from a monthly chart down to a one-minute. All hammer candlesticks are the same, but the bigger the time frame the hammer is on, the stronger the reversal to the upside.

Trading the Hammer Candlestick Pattern

Depending on the formation of previous trends, hammer patterns can often actually be hanging man patterns or shooting stars. Typically, hanging man patterns come after a wave of buying and tend to be bearish indicators. But, hammers form after an aggressive selling wave. Hammers can also sometimes be confused with Doji candlesticks. Doji actually indicates indecision since it contains both upper and lower shadows.

Traders could look for hammers to pull back towards a significant support level on the chart. When this occurs in isolation, with no support to the left, traders prefer not acting upon it. In these cases, traders may wait for a daily close to see if a price reversal takes place.

Technical Analysts also suggest that the pattern becomes more reliable when it is greater than the trading range of prior candles over the period of the last couple of days. Volume is also an important factor to consider. If trade volume has increased from the prior session, it could indicate rising interest in the asset, at the current price level.

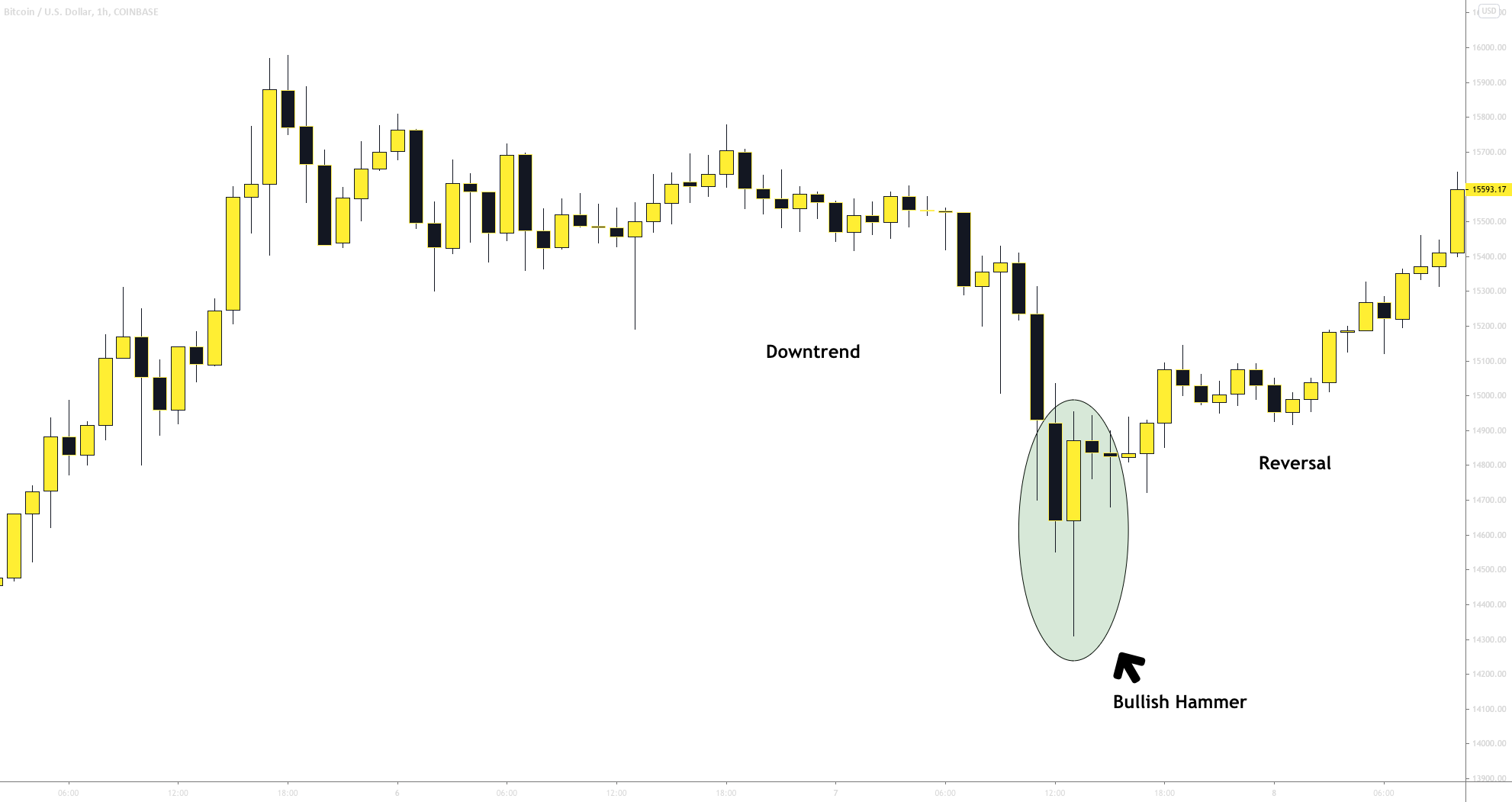

Looking at the Bitcoin chart on the 1-hour time frame, we can see a downtrend followed by a bullish hammer candle which stops the downtrend in its tracks and reverses. The singular hammer candle circled green is one of the sole indicators of this reversal. After the hammer candle, the price reversed back up bullish past the $15,000 mark.

Another example I chose was Delta Airlines on the 1-hour time frame. This chart is a screenshot from the absolute bottom after the coronavirus bottom out earlier in 2020. Delta was in a downtrend (falling knife) from $50 until the price hit $18 and reversed. The singular hammer candle signaled a momentum reversal, and the fact that bulls have regained control over the market. From that one hammer candle, we saw the bullish reversal take place and DAL reached $25 in the next few days.

Types of Hammer Candlestick Patterns

The hammer candlestick is one of the most recognizable candlestick patterns besides the doji candlestick. It appears on the chart in both bearish and bullish markets, different names are used to identify this candlestick pattern depending on where it’s placed on the chart. We learned earlier that the regular hammer candlestick is found at the bottom of a bearish market, indicating a potential bottom and that bulls have regained control. Another type of hammer candlestick is the inverse hammer. The inverse hammer is a bullish reversal pattern that also appears at the bottom of bearish market. Although both of these candlestick patterns paint the same potential reversal pattern, the inverse hammer looks distinctly different. The inverse hammer paints a small green body at the bottom of the candle, while the regular hammer paints a small green body at the top of the candle. These two candlestick patterns are both found at the bottom of a bearish market, while the hammer candlestick at the top of the market is properly identified a hanging man.

Differences Between the Hammer and Hanging Man Pattern

Although there are three criteria that show similarities between the two, there are also three aspects that differentiate the hanging man from the hammer: trend, extent of the move before the candle line, and confirmation.

- Trend: A hammer must come after a decline: A hanging man from the hammer must come after a rally.

- Extent of the move before the candle line: A hammer is valid even if it comes after a short-term decline, but a hanging man should emerge after an extended rally, preferably at an all-time high.

- Confirmation: As will be addressed later, a hanging man should be confirmed, while a hammer doesn’t need to be.

The longer the lower wick, the shorter the upper wick; the smaller the real body, the more meaningful the bullish hammer or bearish hanging man.

Limitations of the Hammer Candlestick Pattern

There is no confirmation the cost will keep on moving to the upside following the confirmation candle. A long-wicked hammer and a strong confirmation candle may push the price very high within two periods. This may not be an ideal spot to purchase as the stop-loss might be a huge span away from the entry point, exposing the trader to risk which doesn’t justify the potential reward.

Hammers additionally don’t give a price target, so figuring out what the potential price for a hammer candlestick trade can be a burden. Traders generally don’t make trades solely based off of a hammer candle, the hammers are generally more useful as a tool to confirm your trading bias, not create a trade based off it. Traders generally use other indicators such as RSI, MACD, and Moving Averages as well as levels of support & resistance to determine the direction of the market, not a single candlestick. Exits need to be based on other types of candlestick patterns or other technical analysis.